When Income Tax Start 2025 - T220251 Distribution of Federal Payroll and Taxes by Expanded, As soon as new 2025 relevant tax year data has been. It will remain at rs 50,000 under both the old and the new income tax. T200040 Average Effective Federal Tax Rates All Tax Units, By, Deadlines set for refund approvals, asset release and compounding proposals; It will remain at rs 50,000 under both the old and the new income tax.

T220251 Distribution of Federal Payroll and Taxes by Expanded, As soon as new 2025 relevant tax year data has been. It will remain at rs 50,000 under both the old and the new income tax.

T200018 Baseline Distribution of and Federal Taxes, All Tax, Updated as per latest budget on 1. For this year, the financial year will be.

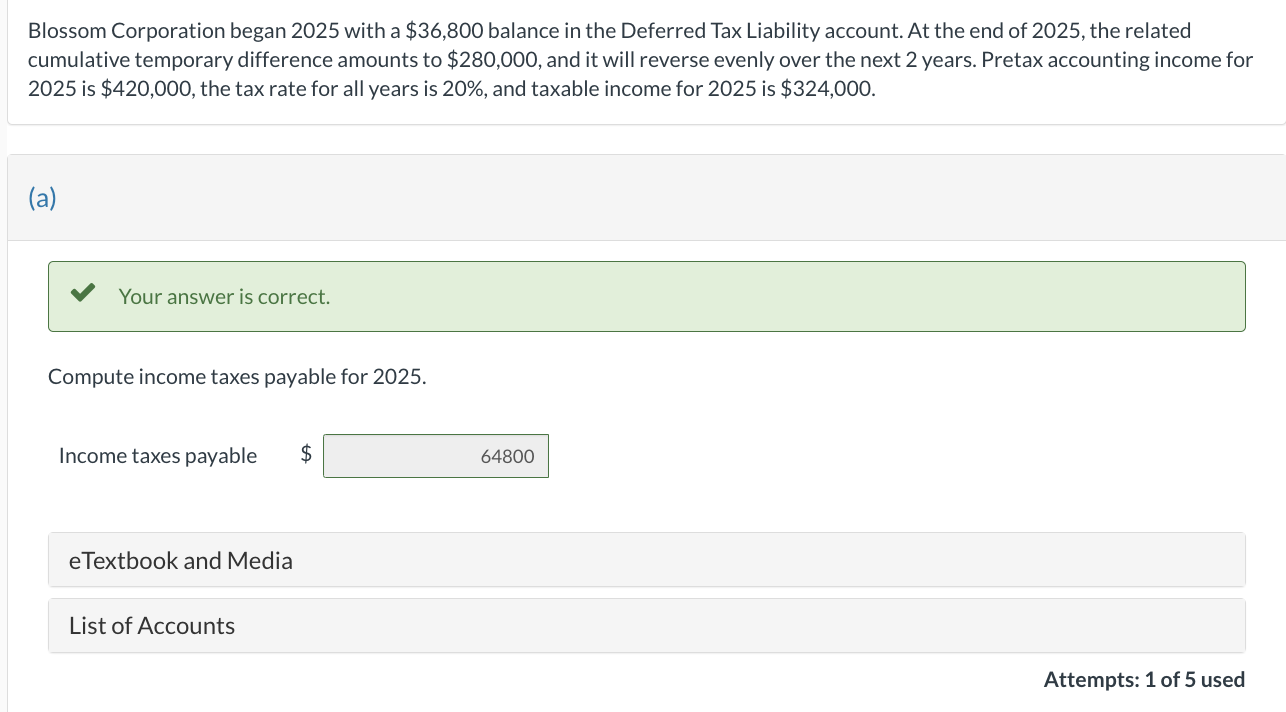

Solved Blossom Corporation began 2025 with a 36,800 balance, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. The income tax return (itr) is a crucial document that records the income earned by an individual or entity during a fiscal year.

Taxes Are Going Up In 2025 TEK2day, You can calculate your tax liability and. Our income tax calculator calculates taxes on the basis of the latest provisions of the income tax act and rules issued by the income tax department.

T180110 Effective Marginal Tax Rates on Wages, Salaries, and Capital, As soon as new 2025 relevant tax year data has been. You can calculate your tax liability and.

Which is the income eligibility threshold for head start,.

It will remain at rs 50,000 under both the old and the new income tax. The income tax return (itr) is a crucial document that records the income earned by an individual or entity during a fiscal year.

T200054 Share of Federal Taxes All Tax Units, By Expanded Cash, You can calculate your tax liability and. Our income tax calculator calculates taxes on the basis of the latest provisions of the income tax act and rules issued by the income tax department.

One can use the online income tax calculator to arrive at the exact income tax amount which is payable by the assessee to the government.

T210120 Share of Federal Taxes All Tax Units, By Expanded Cash, An individual has to choose between new and old tax regime to calculate their income tax liability, subject to certain conditions. Calculate your tax liability with new regime tax calculator, know how much tax you will have to.

When Income Tax Start 2025. One can use the online income tax calculator to arrive at the exact income tax amount which is payable by the assessee to the government. In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay).